By HOPE O’DELL

Capital News Service

LANSING – Michigan farmers can’t plant more wheat this year to make up for Ukrainian and Russian production that’s been lost to the ongoing war.

Combined, Russia and Ukraine account for 30% of the world’s wheat production, said Scott Swinton, an agricultural economist at Michigan State University.

According to Bloomberg News, Russian exports are at near-normal pace, but that could change as sanctions get tougher.

“A third of the world’s supply comes from an area that’s now offline,” he said.

Michigan farmers can’t make up for that loss, Swinton said, because Michigan, Ukraine and Russia produce soft winter wheat. It was planted last fall and will be harvested in the summer.

A fixed supply and consistent demand for wheat leaves one thing open to change: price. Michigan farmers are seeing higher prices for their crops amid the unpredictable war and increased production costs.

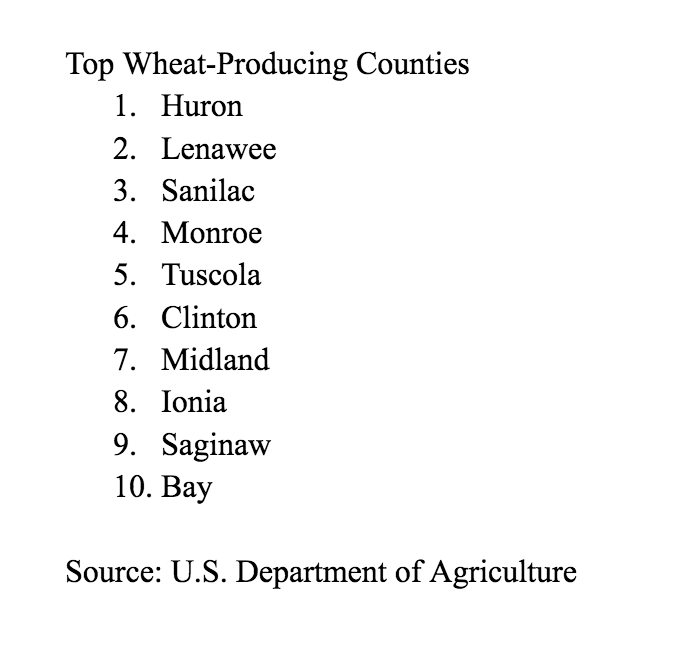

U.S. Department of Agriculture

Top 10 wheat-producing counties.According to the U.S. Department of Agriculture, Michigan produced $281.2 million worth of wheat in 2021.

In the same year, Ukraine exported $5.1 billion worth of wheat, according to the American Farm Bureau.

That left a big hole to fill when Russia invaded Ukraine, and Michigan farmers felt the bump, Swinton said.

“When Michigan farmers planted their winter wheat last fall, prices were around $7.20 a bushel,” Swinton said. “A week or two after the Ukraine war started, they spiked to $13 a bushel.”

Theresa Sisung, an industry specialist with the Michigan Farm Bureau, said wheat prices have stabilized since their peak in the beginning of March.

Even so, “they are still quite a bit higher than what would be considered a more normal price,” she said.

The current price is about $11 a bushel if farmers sell their crop in May, according to the Farm Bureau’s table of futures prices.

Many farmers contract to sell their crop before it’s harvested to lock in the current predicted price, or the futures price, Sisung said.

For example, if a farmer contracts to sell in May for $11 a bushel, the grain elevator must buy the agreed-on number of bushels, with $11 as the starting price, although elevators have some control over the final price.

Sisung said while the market’s up, farmers who haven’t already contracted to sell are trying to take advantage of the high prices.

If the Ukraine-Russia war continues for a long time, Sisung said, prices will continue to rise, especially if it lasts into summer –– the harvest season.

On the other hand, Swinton said, even if the war is cut short, there will still be fallout because the

displacement of millions of Ukrainians, along with damage to infrastructure, has hurt the country’s ability to harvest its crops.

“Even if the war were to end today, I don’t think that Ukrainian farmers would be able to harvest as much as usual,” he said.