When the COVID-19 pandemic hit in 2020, businesses closed doors, restaurants stopped serving food and sporting events were put on hold. One thing that didn’t stop, however, was East Lansing’s income tax. In fact, the tax has done better than was projected.

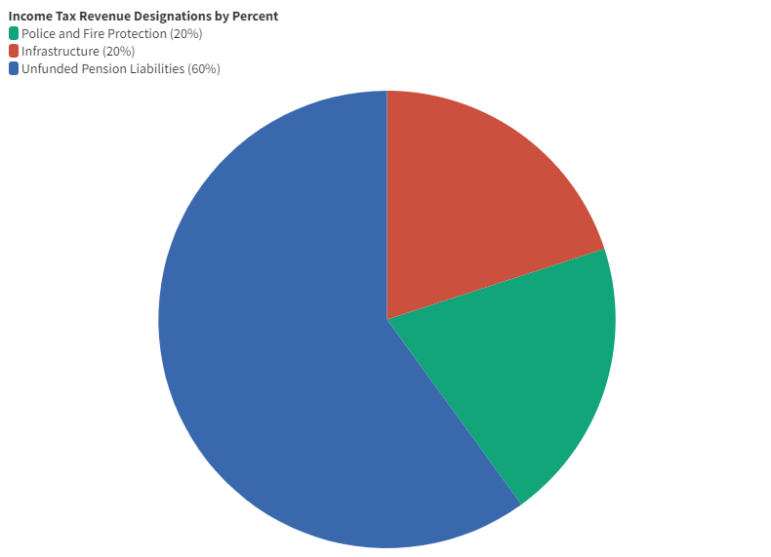

In 2019, East Lansing implemented a 1% income tax on residents and a 0.5% tax on non-residents. The tax was established, in most part, to address unfunded pension liabilities that were found by a financial review team. Portions of the income tax revenue are also designated to go toward infrastructure and public safety.

Jacob Phillips

The revenue generated from East Lansing’s income tax is divided amongst pension liabilities, infrastructure and police and fire protection.In 2020, less than a year after the tax began, many individuals were forced to work from home. This meant the city lost 0.5% from non-residents as people who normally commuted into East Lansing were no longer making money within city limits. Any income decline by East Lansing residents also cut tax revenues.

With the pandemic still taking its toll, the city is unable to calculate precisely how much revenue has been lost as a result. “We have yet to have a regular year,” said Jill Rhode, income tax administrator for the City of East Lansing. “[We] don’t have enough information to know what was lost.”

The loss of non-residential income tax revenue is not specific to East Lansing. Ronald Fisher, a professor of economics at Michigan State University specializing in subnational government taxation, explained that all localities with an income tax are affected by the pandemic. “Even in smaller places, like East Lansing, it’s going to have a major effect.” Any city with a tax on non-residential workers is facing a loss of income tax revenue.

Jacob Phillips

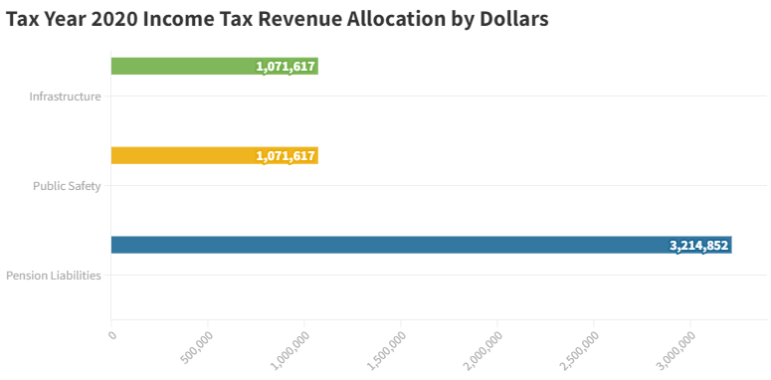

In 2020, East Lansing allocated $3,214,852 to pension liabilities, $1,071,617 to public safety and $1,071,617 to infrastructure.Despite the lost revenue for East Lansing, the income tax has continued to generate more revenue than predicted. According to Jill Feldpausch, finance director for the City of East Lansing, the initial projection for net new revenue generated by the income tax was approximately $5 million. In tax year 2020, the income tax generated $5.36 million in revenue for the city. Feldpausch said it “Doesn’t feel like lost revenue to us” because the revenue is still exceeding the projection. She also explained how more revenue will be generated going forward as people return to work in the city and pay the tax.