By KYLE DAVIDSON

Capital News Service

LANSING — Education about scams that victimize older people can reduce the likelihood of victimization by 40%, according to the Financial Industry Regulatory Authority’s Investor Education Foundation.

Throughout the state there are many organizations working to educate elders and protect them from scams.

Established in 2013, AARP’s Fraud Watch Network gathers information on scams and fraud involving debt collection, identity theft, politics and social security.

The network provides resources including reporting services, articles raising awareness on prominent types of scams and bi-weekly watchdog alerts that send out emails about the most recent scams.

AARP also offers an interactive map that allows users to search for reports of scams in their area, drawing from both user reports and law enforcement alerts.

While the program is run by AARP, it collaborates with agencies like the Attorney General’s office to provide information on local scams.

Created to combat the growth of telephone and internet fraud, the network seeks to raise awareness. According to its website, older people are typically targeted because of their assets like social security and retirement funds.

Mark Hornbeck, the associate director of communications for AARP Michigan, said, “It’s important to get information to older adults on the fraud and scam operators out there so they can be prepared to spot warning signs, prevent being victimized and avoid financial disaster.”

Alongside the AARP Fraud Watch are other programs to protect Michigan residents.

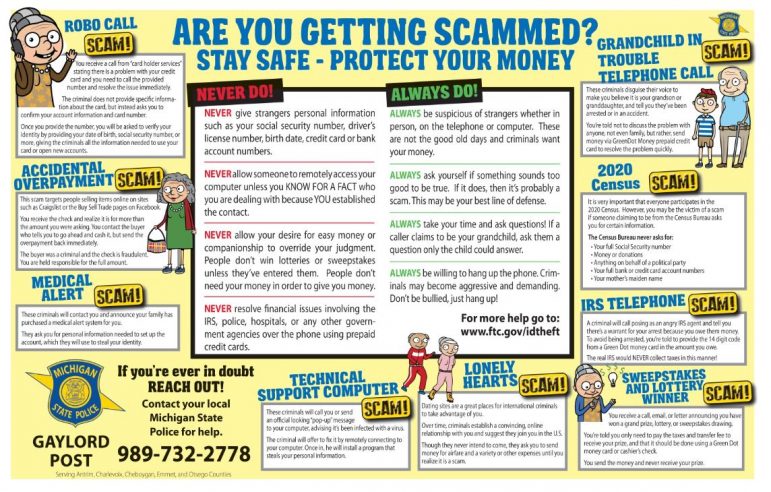

State Police Lt. Derrick Carroll said his 7th District designed a placemat that lists common scams that victimize elders.

Carroll said, “We printed out these placemats and we tried to think. We’ve done things in senior centers and community centers locally, but who are we missing? Well, we were missing the homebound seniors.”

To reach them, Carroll said the State Police partnered with Meals on Wheels to distribute placemats to homebound clients with region-specific information on how to report a scam.

The department said drivers received almost 6,000 placemats for residents throughout the district, which covers most of the Northern Lower Peninsula. That includes Emmet, Cheboygan, Antrim, Montmorency, Leelanau, Benzie, Grand Traverse, Crawford, Alcona, Manistee, Wexford, Missaukee, Otsego, Kalkaska, Oscoda, and Roscommon counties.

In Southeast Michigan, the Wayne State University Institute of Gerontology provides free services to combat the financial exploitation of older adults.

Director Peter Lichtenberg explained that while older adults are not more likely to be scammed, older adults are more likely to fall victim to certain types of fraud. They include IRS impostor scams and “grandparent scams” where a scammer pretends to be a relative requesting money for emergency reasons.

Scams fall into a number of categories.

For example, the State Police Houghton Lake post received reports of how an area man was asked to send money to avoid being arrested.

The Lottery also warned of a scam claiming residents had won and needed to pay a collection fee to obtain their prize.

Officials also warned citizens earlier this year to disregard phone calls where scammers posed as members of the Department of Health and Human Services asking for personal information.

Wayne State’s Older Adult Nest Egg program was created as a tool for social service workers to determine whether a user is making safe financial decisions.

Partnering with Adult Protective Services to share information from across the state on financial exploitation investigations, the program provides adults with additional protections, Lichtenberg said.

Along with the Nest Egg program, Lichtenberg created the Successful Aging thru Financial Empowerment (SAFE) program to provide financial coaching to scam and identity theft victims.

The program offers one-on-one coaching that can be done virtually on subjects like budgeting, record-keeping, scam prevention and identity theft recovery.

Lichtenberg said older scam victims may not be savvy enough to recover and could face a number of credit problems. The SAFE program helps victims recover some of that lost money.

Alongside those programs, the Attorney General’s office provides resources on its website. With a scam-of-the-day update and information on scams in the news, the website also provides warning signs of common scams.