By IAN K. KULLGREN

Capital News Service

LANSING — As lawmakers wrangle over how to fix the state’s crumbling road system, one group is increasingly volunteering to foot the bill: Local taxpayers.

More than a third of counties now have local property tax increases in place to help fund road maintenance.

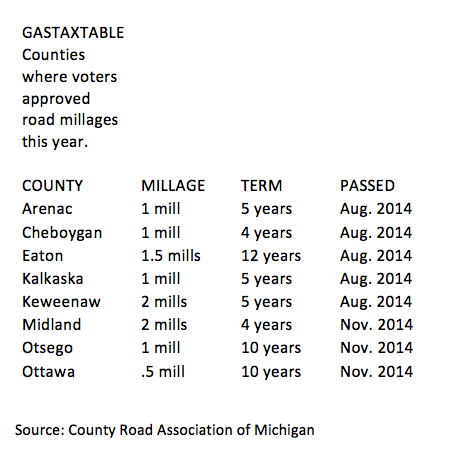

In 2006, voters in 12 counties had approved local road maintenance levies. That number has now risen to 28 as of this year, when eight passed new increases in the August primary and November general elections.

Source: County Road Association of Michigan.

Although the taxes are expected to bring in millions of dollars in additional road funds each year, local leaders say it will barely make a dent, even if the House passes a bill in December to double the gasoline tax.

“We’ve allowed our roads to deteriorate to the point where it will take a combination of local, state and federal dollars to even stop the bleeding,” said Monica Ackerson Ware, communications and development manager for the County Road Association of Michigan.

Local roads have fallen into the worst disrepair. According to the state’s 2013 roads report, 31 percent of minor arterial roads — which help funnel traffic to destinations like airports and shopping centers — and 46 percent of smaller rural roads are in poor condition. That’s compared to 21 percent of larger arterial roads and 11 percent of freeways rated in poor condition.

“It would take us 10 years, if we got proper funding, to see a really big difference in our county,” said David Brandt, chair of the Cheboygan County Road Commission. “We don’t even have enough employees to plow our roads in the winter.”

A Senate-passed bill would convert the current 19-cent-per-gallon tax into a tiered wholesale tax that would increase over the next four years and bring in more than $1 billion annually.

According to the County Road Association, that’s only about half the money needed to fix and maintain the state’s roads. Counties receive 39 percent under the current funding structure. The rest goes to cities and the Department of Transportation.

County roads make up three quarters of all paved road miles but tend to stay intact longer than state and federal roads because of lower traffic volume.

Cheboygan County’s millage, passed in August, will raise about $1 million a year for the next four years — enough for repair work on just six county roads, Brandt said.

The same is true in Grand Traverse County, where voters approved a tax increase in 2013 to bring in an estimated $4.4 million annually.

Eighty percent of the county’s roads are in disrepair, and officials predict it will take 20 years to fix them, even with the additional tax money. In the most optimistic scenario, that time could be cut in half if the state increases the wholesale gas tax.

“I’ve lived in this county my whole life, and they’re the worst I’ve ever seen,” said David Taylor, a member of the Grand Traverse County Road Commission. “We want to tackle our primary roads, but we don’t even have enough money to improve our local roads.”

Voters in thee counties approved road millages this year, according to the association: Ottawa, Cheboygan, Eaton, Keweenaw, Otsego, Arenac, Kalkaska and Midland.

Road funding has emerged as the Legislature’s top priority in the lame duck session, although it’s unclear whether the Senate plan will gain enough support from House Republicans nervous about raising taxes.

Under the proposal, the tax would start at 9.5 percent on April 1, 2015, and ratchet up to 15.5 percent by 2018.

It’s hard to predict exactly how much money that would bring in because tax revenue would rise and fall with gas prices. One concern is that revenues would diminish over the next several decades as vehicles become more fuel efficient.

But right now, county road officials say they’re more concerned with the immediate future.

“We will take anything we can get,” Taylor said. “With the price of gas being down right now and a lame duck session, something will possibly happen. But a year or two ago we were thinking the same thing, and nothing happened.”

Many supporters of a gas tax increase say it could avoid more costly repairs in the future.

According to the County Road Association, every dollar spent on local road repair now would save between $6 and $14 in future years.

Gladwin County was one of the first to pass a road funding increase in 1968. It currently brings in about $1.7 million annually, used strictly for maintenance.

“It’s really helped over the long term,” said Larry Miller, a member of the county’s road commission. “Go to Clare County and Arenac County, and you can tell who’s got the best roads.”